Politicians Never Met a ‘Resource’ That Wasn’t “Available.”

- Government’s “resources” come at our expense, inhibiting our freedom to do more for ourselves, our family, our community

- Taxation chips away at future prosperity

- Politicians’ efforts to grab for more puts us further in debt, entrenches the non-value-added political class, and causes inflation

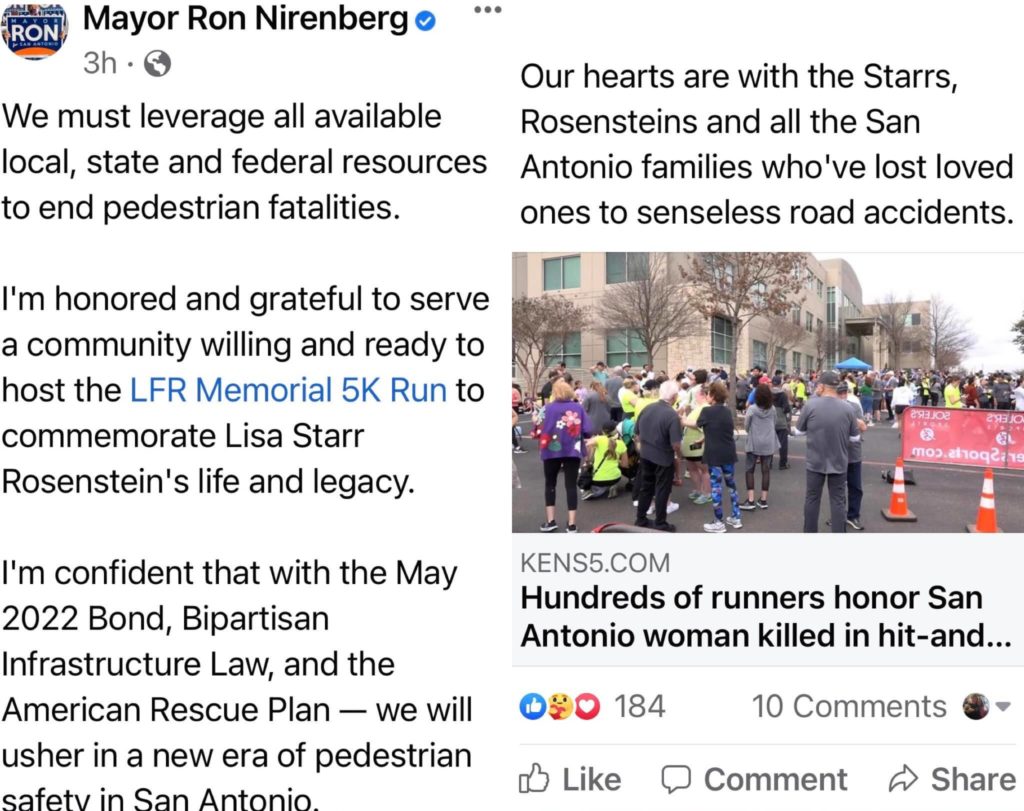

It’s shameful when politicians leverage personal tragedy for political ends.

First off, “local, state and federal” governments have “resources” only insofar as what they forcibly take from citizens first. On the local level, this comes partially in the form of property taxes. On the federal level, this seizure comes from our work effort, otherwise known as the income tax.

The state of Texas has no such tax, though not for lack of suggestion.

The source of our prosperity is our savings. Those savings don’t simply lounge around in our bank accounts. They get invested in new ideas for ventures that others have. Or, we skip the savings account and invest directly ourselves, in stocks and bonds, our 401K, etc.

Or, we invest in our own human capital via school or training. This in turn creates greater future income for us. To come full circle, whatever we don’t spend on everyday expenditures, or perhaps occasional big-ticket purchases, goes into the aforementioned savings account and/or investments.

That is of course after Uncle Sam has taken his cut of our income, and this is where the mayor’s plea becomes disingenuous. Even after he, the city council, the Bexar County Commissioners court and Washington D.C. have taken a swipe at our quality of life borne of good habits, they have developed a habit of creating their own “resources,” though not without consequence.

For decades, accelerating this century, when taxes on income and investments are insufficient to quench the thirst of federal politicians to spend, they borrow. This has resulted in a $30 trillion national credit card bill. Some of this largesse trickles down into local government budgets.

More indirectly is the local gusher created by federal monetary policy.

When the feds talk down the value of the dollar, or outright depress it by keeping the printing presses in overdrive, investors tend to look more for safer, already-establish assets in which to invest. The poor/unstable policy saps their confidence in the future, and adds artificial risk to how the deploy their resources. The most common refuge is gold, but one we’re more familiar with is housing.

As in other areas in which the government has an outsized, counterproductive presence and/or influence upon, such as education and health care, this increased flow of dollars results in inflated prices. And when the value of our home subsequently rises, what else also rises? Our property tax bill.

Regardless of the degree to which local, state and federal lawmakers are in cahoots, they know they can create “available … resources” out of thin air. The resulting inflation makes no matter to them when they can convince just enough voters of the ‘need’ to do so.

What the mayor was saying was the most insincere form of pandering. It’s a wonder he didn’t say “if it saves just one life.” Maybe voters have gotten wise to such messaging. We’ll see in November and the following May.